Car subscriptions: Change your car every month, and cheaper than buying?

Car shopping is probably one of the most stressful activities you’ll ever undertake, thanks to the amount of money involved and the utter disdain for customers at most car dealerships. Add the generational shift towards app-based on-demand and subscription services for everything from hailing a taxi to watching TV shows, the urge to actually own a car for mobility is diminishing among certain sections of young affluent consumers. As a logical progression, now there are even car subscription services where you can sign up to use a car for a month using your smartphone, pay a monthly fee with all service and maintenance included without being locked into a multi-year lease, and the car gets delivered to you. With no strings attached, it is even possible to switch cars every month. But is it really cheaper than buying a car outright?

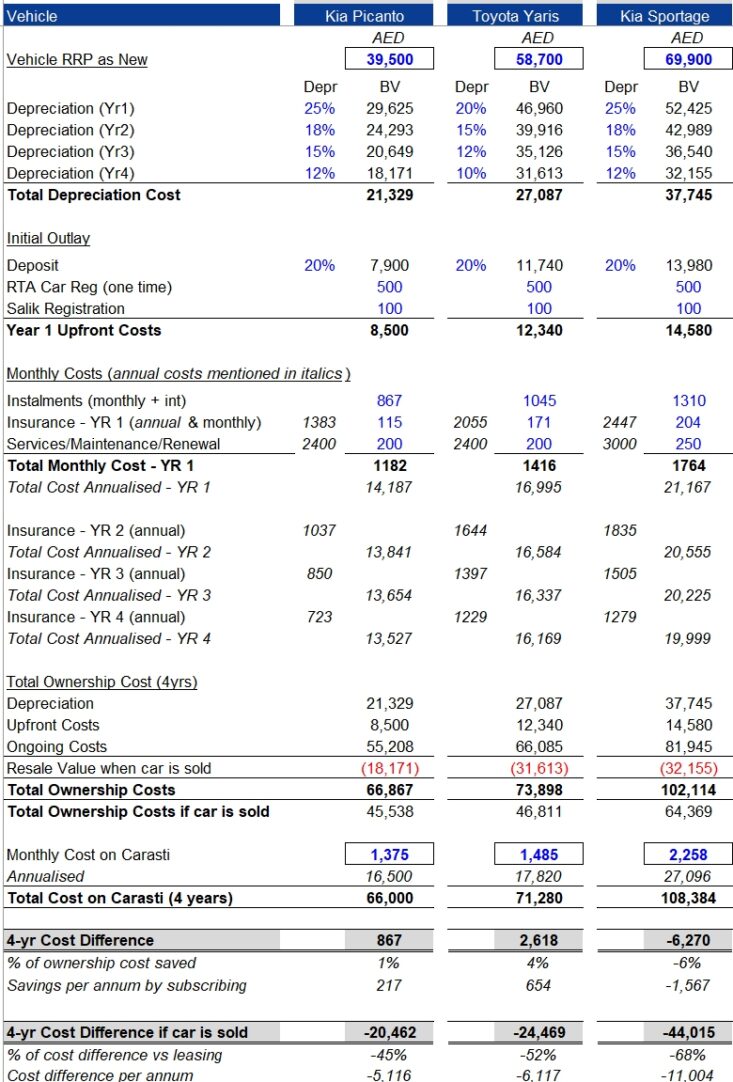

We teamed up with Carasti, a new car subscription app in Dubai, to check out the pros and cons of the car subscriptions.

The financial process of buying or renting a car has not changed in years, and has largely not caught up with the expectations of millennials. For many of them, car buying is no longer seen as an achievement or status symbol, but more as a depreciating burden. That especially holds true for luxury cars, as that same money could be used to pay the mortgage on an appreciating, revenue-generating property instead.

The Carasti app offers car subscriptions, and is the best when it comes to variety, from Kia to Ferrari. The process is simple — you download the app, select the car of your choice, your delivery location and timeslot, upload your Emirates ID and driving licence, enter credit card details and you’re done, with no additional paperwork. Most of the cars don’t even require a deposit. Listed below is a selection of cars offered on the platform, and we compared the monthly cost of buying and maintaining a car on bank loan versus just subscribing to a car.

As you can see, taking the monthly loan payments with interest, insurance premiums and an average estimate of maintenance costs (including tyres, major service, etc.) into account, the difference between a car subscription and buying your own car for use over the next four years is within 6% of each other for a regular commuter car after four years. Purely as a monthly expense, you will even save a bit of money on the smallest cars.

However, what you will also note is that, after four years, you still own a car that has some value. So if you sell it after four years, you get some money back, whereas you don’t get anything back with a long-term lease.

Now you may ask what’s the benefit of a car subscription then — simply the short-term flexibility. You are not shackled to a long-term car loan when, as an expat, you’re not even sure if you’ll be around for the next few years. That, and the massive relief from running after renewal and maintenance hassles.

The subscription has the added benefit of driving a brand new car all the time, and being able to swap out to other new cars at any time, so you can pay more and drive a bigger SUV or a luxury car for a month here and there if you feel like it or when you need it while your parents visit the country. That’s pretty convenient if you prefer to drive new cars and do a lot of driving. In the fourth year, you’re still driving a new car instead of a 4-year-old one that is starting to have problems. Do your own math and let us know your conclusions.

The mileage limits are also pretty high on the car subscriptions (4500 km on most of the regular cars with 50 fils per km beyond that), so all you’re paying for is tolls, petrol and parking. The cars themselves are sourced from leasing agencies, but without the typical deposits and long-term contracts in most cases. A replacement car is also provided if your current subscribed car is due for service or has a problem.

The way buying a car truly makes sense is if you are sure you will stay in the region for a long time; if you are buying some rare special-edition dream car; if you keep a new bought car for more than just a year; or if you pay cash to buy a used car.

We have been told more flexible options will be offered in the coming months, especially for the supercars and offroad vehicles. In the meantime, Carasti is offering an exclusive Dhs 150 discount off the first month subscription to our readers by entering the voucher code DRIVEARABIA150 (valid till 30th June 2020) upon checkout to try out the service. Let us know how it goes.

Comments

Mohandoss Raghavan

It’s better to own the car because you will have the car with you. You can get money when selling. Further own the car at rental costs the car is yours after your EMI tenure.

Simple and practical.

Essam eldally

Contact me through my e mail about E-Vehcels also Hyperd one

Sagar Kasula

Buy from authorised dealer of with 2 yrs old car on installment this would be cheaper than rental basis….

Jon

Hi, seems like the depreciation has been included twice in the total ownership costs. Please re-check your calculations, thanks,

Mashfique Hussain Chowdhury

Looks fine to us. Depreciation is mentioned twice but counted only once.

Jon

It’s been included indirectly. Upfront + ongoing costs – Resale value (the last three lines) includes the depreciation once. Its added again as a separate line on top. Hope this clarifies.

Mashfique Hussain Chowdhury

Thanks a ton, Jon. Fixed.

Karim

You should not count depreciation in the cost of ownership.. these figures are wrong.. you don’t pay depreciation for it to be in cost of ownership.. cost of ownership is simply: what you have paid so far for this car..

Arun

Please do the above calculation for used cars, you have lower initial costs, lower average monthly costs, (as car’s price is lower) and much lower depreciation.

Mashfique Hussain Chowdhury

It’s mentioned used cars are cheaper. This is for those who want to drive new cars yearly.

Mosa

It would be interesting to read the ‘Terms & Conditions’ for this kind of service, and the MASSIVE penalty clauses even if you get a tiny scratch or dent caused by someone else’s vehicle. My primary reason for walking out on a rental plan which i followed for 4 years and going ahead with my own vehicle was that I was exhausted of dealing with these rental guys and their annoying reasons for penalizing me for every unavoidable issue.

Point being; Its not appropriate to claim renting a vehicle is more beneficial than owning one; there are pros and cons – for both.

jiju

its is expensive. insted we can buy used car cheaper than this